Navigating the Stock Market Landscape in 2025: A Comprehensive Guide

Related Articles: Navigating the Stock Market Landscape in 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Stock Market Landscape in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Stock Market Landscape in 2025: A Comprehensive Guide

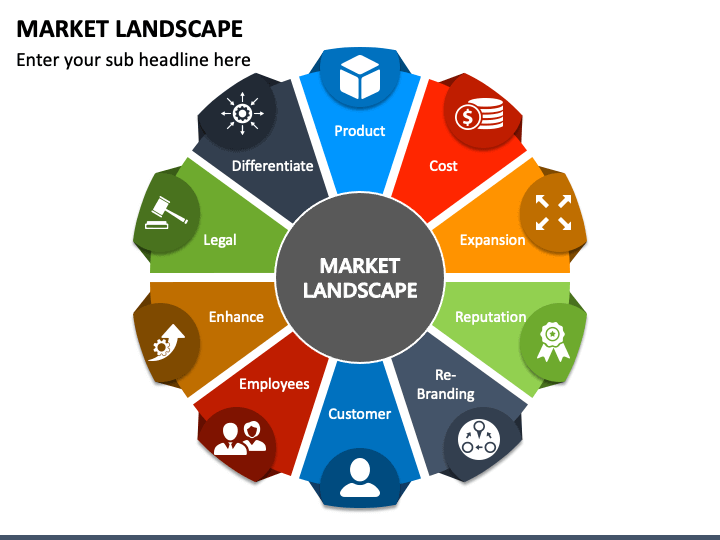

The stock market is a dynamic and intricate system, constantly evolving in response to global events, economic trends, and investor sentiment. Predicting the future of the market is a complex endeavor, but understanding the potential drivers and challenges can equip investors with valuable insights. This article delves into the potential landscape of the stock market in 2025, exploring key factors that could shape its trajectory and offering guidance for investors.

Key Factors Influencing the Stock Market in 2025

1. Technological Advancements:

Technological innovation remains a potent force driving economic growth and shaping investment opportunities. Artificial intelligence (AI), automation, and the Internet of Things (IoT) are expected to continue transforming industries, creating new markets and disrupting existing ones. Investors need to identify companies at the forefront of these advancements, particularly those developing and deploying cutting-edge technologies.

2. The Global Economic Outlook:

Global economic growth is expected to remain a key factor influencing stock market performance. Factors such as inflation, interest rates, and geopolitical tensions will play a significant role. Investors need to assess the economic prospects of different regions and industries, seeking out companies positioned to benefit from positive economic trends.

3. Climate Change and Sustainability:

Climate change is a growing concern, prompting investors to prioritize companies committed to environmental sustainability. The transition to a low-carbon economy is creating opportunities for businesses developing renewable energy solutions, sustainable technologies, and responsible practices.

4. Demographic Shifts:

Aging populations and changing consumer preferences are reshaping industries. Healthcare, senior care, and consumer goods tailored to evolving demographics are likely to see increased investment.

5. Regulatory Landscape:

Government policies and regulations can significantly impact the stock market. Investors need to stay informed about changes in tax laws, trade agreements, and other regulatory frameworks that could affect specific industries or sectors.

6. Geopolitical Risks:

Geopolitical tensions, trade disputes, and global conflicts can create uncertainty and volatility in the stock market. Investors should monitor these developments closely and consider their potential impact on specific investments.

Investing Strategies for 2025

1. Diversification:

Diversifying investment portfolios across asset classes, industries, and geographies is crucial to mitigate risk and enhance potential returns.

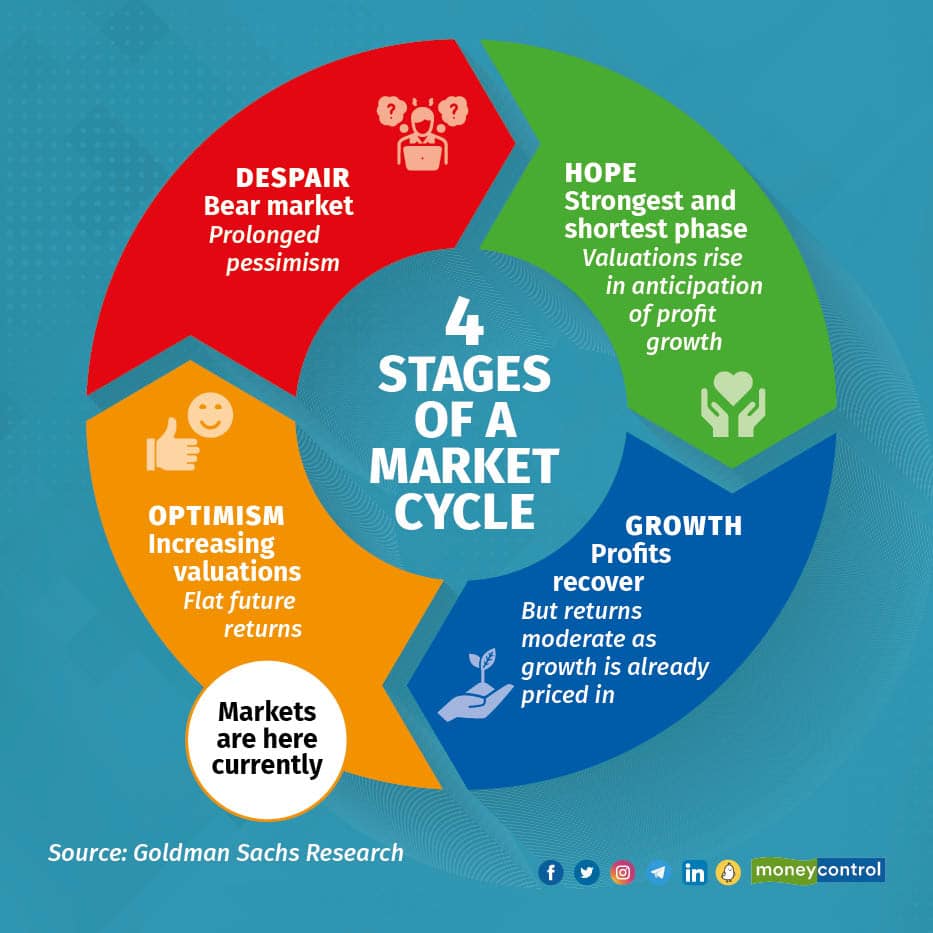

2. Long-Term Perspective:

The stock market is cyclical, and short-term fluctuations are inevitable. Investors should adopt a long-term perspective, focusing on companies with strong fundamentals and growth potential.

3. Fundamental Analysis:

Thorough research is essential. Investors should analyze companies’ financial statements, management teams, competitive landscapes, and industry trends to identify promising investment opportunities.

4. Value Investing:

Identifying undervalued companies with strong potential for growth can yield significant returns. This approach requires patience and a focus on long-term value creation.

5. Active Management:

Actively managing investment portfolios, adjusting holdings based on market conditions and company performance, can help maximize returns.

6. Technology-Driven Investments:

Investing in companies driving technological innovation can offer significant growth potential. However, careful due diligence and risk management are crucial.

7. Sustainability Investing:

Investing in companies committed to environmental, social, and governance (ESG) principles aligns values with investment decisions, contributing to a sustainable future.

FAQs

1. What are the key sectors expected to perform well in 2025?

Sectors expected to perform well in 2025 include technology, healthcare, renewable energy, and sustainable infrastructure.

2. What are the potential risks to the stock market in 2025?

Potential risks include economic recession, rising interest rates, inflation, geopolitical tensions, and regulatory changes.

3. How can investors navigate market volatility in 2025?

Investors can navigate market volatility by diversifying their portfolios, adopting a long-term perspective, and maintaining a disciplined approach to investment decisions.

4. What are the most important factors to consider when choosing investments for 2025?

Key factors include company fundamentals, industry trends, growth potential, risk tolerance, and investment goals.

5. How can investors stay informed about market developments in 2025?

Investors can stay informed by following financial news, reading industry reports, consulting with financial advisors, and utilizing online resources.

Tips for Investors

- Develop a comprehensive investment plan: Define your investment goals, risk tolerance, and time horizon.

- Stay informed about market trends: Monitor economic indicators, industry news, and company performance.

- Seek professional advice: Consult with a qualified financial advisor to tailor investment strategies to your specific needs.

- Be patient and disciplined: Avoid impulsive decisions and stick to your investment plan.

- Continuously evaluate your portfolio: Regularly review your holdings and make adjustments as needed.

Conclusion

Navigating the stock market in 2025 requires a balanced approach, considering both potential opportunities and risks. By understanding the key factors influencing the market, implementing sound investment strategies, and staying informed about market developments, investors can position themselves for success. While predicting the future is impossible, a proactive and informed approach can enhance investment outcomes in the ever-evolving landscape of the stock market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Stock Market Landscape in 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!